Liquidity Providers Rewards Program

Overview

- Phase I Blog: here

Over the past year (Beginning April 21st, 2023), Iagon introduced and ran the LSPO program which sought to incentivize the growth of liquidity in both partnered liquidity pools across various DEXes and the Iagon ADA stake pools.As of Epoch 482 (April 28th, 2024) Phase I of the Liquidity Providers Rewards Program has come to a close.

The program was by all means a tremendous success, growing the Iagon stake pools to over 80M ADA and establishing deep liquidity of over 4.7M ADA in TVL across all DEXes.

Phase I Rewards

Over the course of Phase I, a staggering 30 million IAG was awarded to participants of the program. These rewards will be distributed over a 12-month vesting period, with the first period commencing mid May, 2024.

Rewards will be claimable each month through the DripDropz platform here

Phase II

Given the success of the LSPO, the Iagon team has decided to extend the program in a modified format.

As of May 1st, 2024, Phase II of the program will commence for an additional 1 year period. Similarly to Phase I, participants will be incentivized to provide liquidity for the IAG/ADA token pair and delegate their ADA to the Iagon staking pools, however, the rewards for the second phase will see the introduction of tokens from various partner projects.

What is an LSPO

As a precursor to the second phase, we want to give a quick overview of the program for those who are unfamiliar and may be participating for the first time.

An LSPO (Liquidity Stake Pool Offering) is similar to a traditional ISPO but will commit all raised proceeds to enhancing the depth of liquidity across various exchanges.

This form of fundraising is possible due to the native liquid staking that is possible on Cardano, allowing participants to forgo the yield on their staked ADA, delegating it to Iagon and receiving various rewards from the LSPO program.

Since the purpose of the program is to enhance the depth of liquidity on exchanges, the LSPO will not only reward users for delegating their ADA to the Iagon stake pools (which in turn will generate ADA that will be used as liquidity on exchange), but it will also reward users who directly provide liquidity to the IAG/ADA pairs on various decentralised exchanges.

By incentivizing participants to aid in the bootstrapping of liquidity across exchanges, Iagon can greatly enhance the depth of liquidity for the IAG token, lowering volatility and improving to the availability and viability of trading the token.

Partnered Projects

The following are projects that we have partnered with to bring enhanced rewards to the participants of Iagon LSPO. Each project has committed a portion of their token supply to rewards users of the program

Saturn Swap

Saturn Swap is the fastest, simplest Decentralized Exchange (DEX) on the Cardano Blockchain. Saturn Swap allows users to quickly trade tokens on Cardano by directly interacting with public smart contracts.

Traditionally, DEX's on Cardano place an order into a smart contract that fills very slowly over the course of a few minutes with a central batcher. Saturn Swap changes the model, allowing users to directly interact with the smart contracts for instant trades.

Find out more: https://saturnswap.io/

Nuvola

Nuvola is the first DePIN aggregator on Cardano seeking to break down the barriers of entry through an innovative crowd-share model, democratizing access to the rewards of decentralized infrastructure and empowering widespread participation, regardless of technical expertise.

Find out more: https://www.nuvoladigital.io/

Phase II Details

- Start: Epoch 483 Dates can be checked here

- End: Epoch 556 (73 Epochs)

Rewards

- IAG Tokens (From 10% buyback of ADA rewards for IAGL1/IAGL2 pools)

- Up to 1% of Saturn Swap token supply (Up to 1,000,000 tokens)

- Up to 2% of NVL token supply (Up to 420,000 tokens)

- IAG, FACT, COPI, MNT (Minutes Network) from Nuvola staking

- Additional tokens are still to be announced

Claim

The reward distribution timeline is as follows:

All the rewards will be made available 73 epochs (12 months) after the period in which they were earned.

Use of Funds

The ADA generated from the Iagon stake pools will be used in the following ways:

- 85% will be used to provide liquidity on exchanges.

- 10% will be used to buyback IAG (this is used for rewards above)

- The remaining portion will be used by the Iagon team and can potentially be used in the future for liquidity providers.

How to Participate

As in Phase I, participants can earn rewards through the following ways:

Delegate ADA to the Iagon Stake Pools

👉 IAGL2 Pool ID: cd0b7a6e8c22110113a9cffc266270e916a6e7ce2189917c70deebdd - link is here

👉 IAGL1 Pool ID: pool1ztk6dcj2nc3plnujf3ek6jqngtx8hcryufz56lyumemlcy2xxn0 - link is here

Tutorial for how to stake to the IAGL pools: check the tutorial

Ensure you are aware of pool saturation prior to delegating. IAGL2 was put in place due to the overwhelming interest in the for IAGL1 pool. Rewards are calculated the same regardless of which pool you are delegated too. We encourage you te delegate to IAGL1 pool since the pool is generating more rewards.

Provide liquidity to VERIFIED pools on our partnered DEXes

Participants can earn rewards by providing liquidity to the verified IAG/ADA pools across most Cardano DEXes, links to the official partner DEXes can be found here:

- (IAG/ADA) Minswap - https://app.minswap.org/liquidity

- (IAG/USDM) Minswap - https://app.minswap.org/liquidity

- (IAG/ADA) Wingriders - https://app.wingriders.com/pools

- (IAG/ADA) VyFinance - https://app.vyfi.io/

- (IAG/ADA) Spectrum Finance - https://spectrum.fi/

- (IAG/ADA) Saturn swap - https://saturnswap.io/liquidity

When selecting your tokens, be sure to choose IAG and ADA (or USDM) and double-check that they are verified to ensure your participation in the program.

Commitment to Safety

Our commitment to the safety and security of our pool runs deep. We've left no stone unturned in our efforts to protect against potential supply chain attacks. We've rigorously tested for privilege escalations and subjected our pool to multiple rounds of security audits.

Our efforts don't stop there; we're constantly monitoring the performance metrics of our pool through automation and vigilant oversight. We've even gone the extra mile by setting up timesync devices and redundancies to ensure our pool runs like a well-oiled machine.

We take our responsibility seriously, and our users can rest assured that their assets are safeguarded at all times.

How Are Rewards Calculated

Rewards for participating in the Liquidity Program will be based on the size of stake, length of stake, and whether a user-provided liquidity, participated in the stake pool, or both.

Reward will vary in their distribution dependent on the token earned.

All rewards tokens will be made available 73 Epochs (12 months) after the period in which they were earned.

Ex. If You earned rewards in Epoch 848, the rewards will be claimable in Epoch 921.

This distribution timeline is subject to change dependent on the method on distribution.

Calculating Rewards

Rewards for the Liquidity program can be calculated here: https://calculator.iagon.com/

With just a few clicks, you're able to see how your contributions can earn you rewards over time with several parameters:

- your stake period (length you stake your liquidity in the pool)

- amount you stake

- amount you delegate to LSPO pool (IAGL1)

- length you delegate with the LSPO pool (IAGL1)

This powerful tool takes the guesswork out of calculating your potential rewards and makes it easier for you to understand the benefits of participating in our program.

How are rewards Calculated?

We understand that not everyone is interested in the technical details and complex calculations that go into our liquidity rewards program. That's okay because we're here to make things as easy as possible for you.

If you're simply looking to participate and earn rewards for your liquidity, you can skip the technical jargon and focus on the simple steps for providing liquidity.

We want everyone to be able to participate and benefit from this program, regardless of their technical expertise. So don't worry if you're not a tech wizard - we've got you covered!

But below you can check technical and math details on how rewards will be calculated. We will use such reward computation function that would meet the following requirements:

We will use such reward computation function that would meet the following requirements:

- promoting longer locking periods;

- promoting higher locking volumes;

- allowing unlocking at any time (not necessarily continuous, perhaps once per epoch);

- providing an increase in terms of reward value (calculated in USD)

- monitoring the amount of tokens given out as rewards globally (the closer we get to the 0.5-3% limit, the slower the reward increase rate);

- Providing an additional boost for people delegating tokens as part of the LSPO.

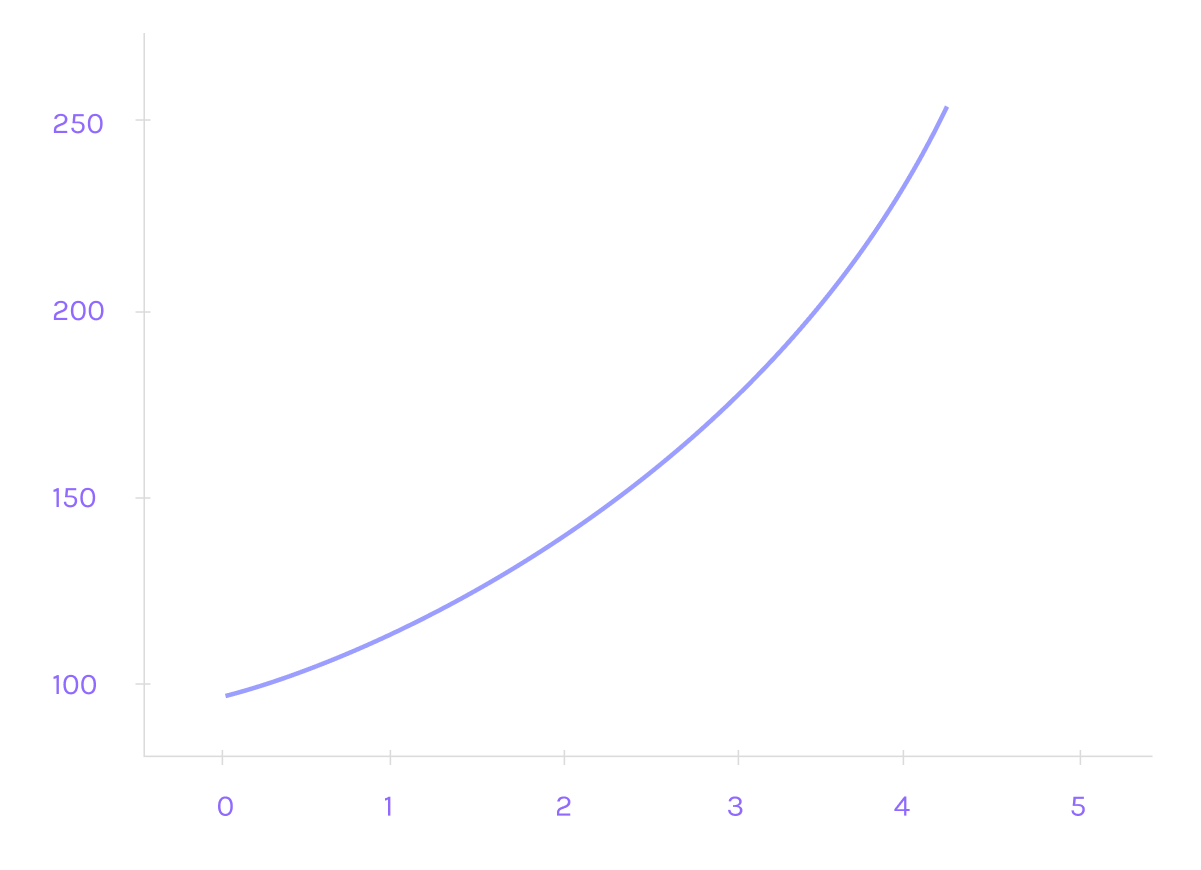

The first two requirements suggest that the reward function should be superlinear in time and volume (if it was linear, there would be no difference between locking for many shorter periods and one longer period; the same can be said for locked amounts). If we consider the way continuous compounding of interest is handled, we could suggest an exponential relation i.e.:

where:

- A0 is the amount of locked tokens,

- t0 is the moment in time the tokens were locked,

- t is the moment of unlocking,

- Vt is the token value (e.g. in USD) at the moment of unlocking (we divide by it to make the growth exponential in terms of value, not token amount),

- α is the degree ofa.g. around 1.2m but this needs to be determined),

- β is the growth coefficient (to be determined as well).

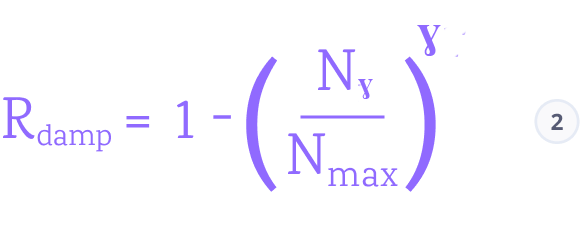

Now, formula (1) is reasonable if the overall amount of tokens given out as rewards is far below the upper limit. When it begins to approach that point, we will need to start damping the exponential growth. The idea is to multiply the exponential component by another function that starts at 1 but tends to 0 as we reach the limit. One idea for such a function is:

where:

- Nγ is the total amount of tokens given out as rewards so far,

- Nmax is the maximum allowed amount of tokens provided for rewards (i.e. 0.5-3% of the total token supply at the moment),

- γ is the damping coefficient (higher values of γ will make this component stick close to 1for longer, at the price of a steeper increase as we come near to the limit; lower values would make the initial drop more drastic).

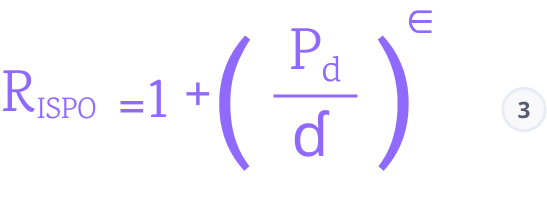

Finally, we need another multiplicative term that reflects a person's participation in the LSPO. For someone not participating, this term should just be 1 and have no bearing on the overall reward. In the case of participants, it makes sense to consider their relative contribution (percentage). Two open questions (reflected by two additional parameters) are:

- What is the maximum reward boost for a hypothetical case of a sole participant?

- How should the increment due to LSPO participation grow with a growing percentage? Should it be linear, sublinear, superlinear?

This leads us to the following candidate function:

where:

- Pd is the fraction of a person's delegated tokens compared to the total volume (a real number between 0 and 1),

- ε is the coefficient determining how the LSPO increment depends on Pd (an ε of 1 would mean a linear relationship, higher values would favor high percentages disproportionately, and lower values would favor moderate participation),

- δ is a coefficient limiting the maximum reward boost due to participation in the LSPO (if δ is small, a hypothetical sole LSPO participant would see a drastic increase in their reward; if it's large, the LSPO effect on the overall reward is negligible; δ ≈ 2 translates to a boost by a factor of 1.5 in the extreme case).

The final reward function is the product of (1), (2), and (3):

Previous ISPO

Iagon held an ISPO (Initial Stake Pool Offering) that spanned from April 2022 - February 2023 and saw a total of 70,000,000 $IAG tokens get distributed to delegates of the stake pool.

The ISPO event is no longer active, participants wishing to participate should look to our LSPO to find out how they can earn rewards by delegating their ADA.

Claiming Rewards

In February 2023, Iagon airdropped 17.5% of all ISPO rewards to ISPO participants.

The remaining rewards were subject to a 12-month linear vesting schedule and have been released proportionally month by month, available to be claimed by participants through the Tosidrop platform.

For community members who participated in our original ISPO, rewards can be claimed at tosidrop.io

Rewards are made available on the 5th day of every month.

FAQ

Is the LSPO different from the Original ISPO?

YES. The original ISPO was an event we held in the past that ended near the start of 2023. The LSPO is a different program aimed to directly benefit the depth of liquidity across Cardano DEXs.

Can you delegate to the LSPO even if you don’t provide liquidity on a DEX?

YES. Providing liquidity is not a prerequisite for delegating ADA to the LSPO pool. Users can choose how they would like to participate in the Liquidity Program either by providing liquidity on DEXs, delegating to the LSPO or both.

How long do we have to delegate to the LSPO?

The LSPO pool opened in May 2025 (Epoch 483) and will run until May 2025 (Epoch 556)

How do I claim rewards from the Liquidity Program?

Rewards for participating in the Liquidity Program will begin distribution following their respective release schedules. The distribution method is yet to be announced.

Are the Rewards for Phase II of the LSPO different from Phase I?

Yes, phase two will see the introduction of additional tokens, Saturn, NVL, all reward tokens from NVL staking(IAG, MNT, FACT, COPI) and the last token is TBA. Additionally, the IAG rewards distribution through phase II will be smaller than during phase I as proceed from the Iagon stake pools will be used to buy back IAG for distribution as rewards.