Liquidity Providers Rewards Program

Ongoing Rewards. Ecosystem-First. Community-Focused.

Overview

The Iagon Liquidity Providers Rewards Program is a long-term initiative designed to grow and strengthen the liquidity of the IAG token across decentralized exchanges, now expanded to include a variety of tokens from leading Web3 projects.

Originally launched as a Phase-based campaign, the program has evolved into a continuous and expanding rewards system that supports those who:

- Delegate ADA to Iagon’s stake pools (IAGL1, IAGL2)

- Provide liquidity to IAG-ADA and select token pairs on decentralized exchanges

Our goal is to make IAG deeply liquid and accessible while supporting broader ecosystem growth.

This program isn’t limited to phases or temporary campaigns — it’s a long-term commitment to rewarding liquidity providers and expanding the utility of the IAG ecosystem.

You provide liquidity. We reward your support. The ecosystem thrives.

What’s New?

We’ve transitioned away from a Phase-based structure into a rolling, always-on program. Here’s how it works:

- New tokens can be added to the reward pool at any time

- Each token’s distribution lasts 12 months, starting from the date it’s added

- Rewards are calculated based on your liquidity contributions during that token’s active period

This approach offers greater flexibility and ensures long-term incentives without tying rewards to specific campaign windows.

Note: In previous announcements, rewards were introduced in “Phases.” Going forward, what matters is the start date of each token’s reward cycle — not the overall program phase.

Reward Pool Tokens

The following Web3 projects have contributed tokens to Iagon’s Rewards Pool, enabling even greater incentives for active liquidity providers. Each token has its own 12-month rewards cycle starting from its date of entry:

| Project | Reward Token Allocation | Date of Pool Entry |

|---|---|---|

| Iagon | 10% from the payback transactions | Ongoing |

| Saturn Swap | Up to 1,000,000 SATURN tokens (1% of supply) | July 11th, 2024 (Epoch 497) |

| Nuvola | Up to 420,000 NVL tokens (2% of supply) | April 3rd, 2024 (Epoch 485) |

| From Nuvola Staking | $MNT, $COPI, $FACT, additional IAG, BTC, WMT | April 3rd, 2024 (Epoch 497) |

| House of Titans | Up to 800,000 TITAN tokens (2% of supply) | October 13th, 2024 (Epoch 510) |

| Tokeo | 950,000 TOKE tokens (1% of supply) | November 15th, 2024 (Epoch 523) |

| FarmRoll | 8,500,000 ROLL (1,5% of supply) | February 6th, 2025 (Epoch 539) |

| Metera | 10,000,000 METERA (1% of supply) + 4% of all DePIN Index entry/exit fees from Metera protocol | April 12th, 2025 (Epoch 553) |

| Midnight | 194,548.17 NIGHT | TBA |

More tokens will be added continuously — stay updated via Iagon’s official channels.

*The SyncAI token sale was canceled, and the token allocation hasn’t been added to the LSPO reward pool (yet).

Claiming Rewards

All rewards — IAG and third-party tokens — are claimable via DripDropz.

- IAG rewards from buybacks (10% of the total amount bought) begin 1 year after allocation and are distributed over 12 months (73 epochs).

- Other token distributions follow their own 12-month schedules, beginning when they’re introduced into the reward pool.

How We Use ADA

Funds earned from Iagon stake pools (IAGL1 & IAGL2) are reinvested into the ecosystem:

- 85% to provide liquidity on exchanges

- 10% for IAG buybacks used in the rewards program

- 5% reserved for operational and growth-related initiatives

How to Participate

As in Phase I, participants can earn rewards through the following ways:

Delegate ADA to an Iagon Stake Pool:

👉 IAGL1 Pool ID: pool1ztk6dcj2nc3plnujf3ek6jqngtx8hcryufz56lyumemlcy2xxn0

👉 IAGL2 Pool ID: pool1e59h5m5vyggszyafel7zvcnsayt2de7wyxyezlrsmm4a679q3zr

Tutorial for how to stake to the IAGL pools here.

To maximize pool rewards and liquidity, please delegate to IAGL1 until it reaches full saturation. Your rewards are calculated the same regardless of which pool you are delegated too.

Provide liquidity to verified pools on our partnered DEXs:

Participants can earn rewards by providing liquidity to any of the verified IAG-ADA or IAG-USDM pools across most Cardano DEXs.

Links to the official partner DEXs can be found here:

| IAG-ADA | IAG-USDM |

|---|---|

| Minswap | Minswap |

| Wingriders | - |

| VyFinance | - |

| SundaeSwap | - |

| Splash | - |

| Saturn Swap | - |

When selecting tokens to provide as liquidity, be sure to choose IAG and ADA (or USDM) as the pair, and double-check that the pool is verified to ensure your participation in the program.

How Rewards Are Calculated

Rewards for participating in the Liquidity Program are based on the amount of ADA delegated + length of delegation; and/or amount of liquidity provided + how long liquidity is provided.

Rewards will vary in their distribution dependent on the token earned.

All rewards tokens will be made available 73 Epochs (12 months) after the period in which they were earned.

Example: If You earned rewards in Epoch 848, the rewards will be claimable in Epoch 921.

This distribution timeline is subject to change dependent on the method on distribution.

Calculating rewards

Rewards for the Liquidity program can be calculated here: https://calculator.iagon.com/

With just a few clicks, you're able to see how your contributions can earn you rewards over time with several parameters:

- Amount of liquidity provide

- How long you provide liquidity

- Amount of ADA you delegate to one of the Iagon stake pools

- How long you delegate ADA to one of the Iagon stake pools

This convenient tool takes the guesswork out of calculating your potential rewards and makes it easier for you to understand the benefits of participating in our liquidity rewards program.

How are rewards calculated?

For those who are interested in the technical and mathematical details of how rewards are calculated and the thought process behind it, we use such reward computation function that would meet the following requirements:

We use a reward computation function that meets the following requirements:

- Promoting longer locking periods

- Promoting higher locking volumes

- Allowing unlocking at any time (not necessarily continuous, perhaps once per epoch)

- Providing an increase in terms of reward value (calculated in USD)

- Monitoring the amount of tokens given out as rewards globally (the closer we get to the 0.5-3% limit, the slower the reward increase rate)

- Providing an additional boost for people delegating tokens as part of the LSPO

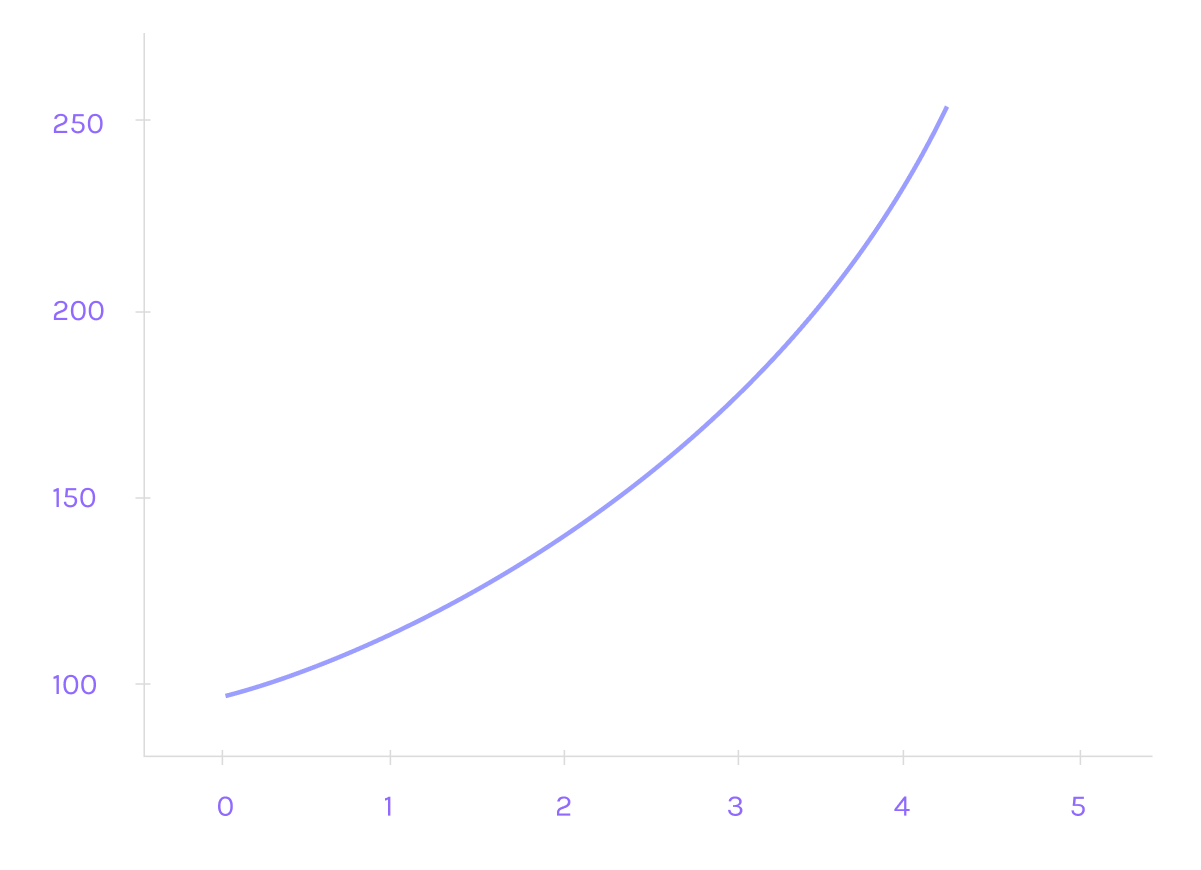

The first two requirements suggest that the reward function should be superlinear in time and volume, as if it was linear, there would be no difference between locking for many shorter periods and one longer period; the same can be said for locked amounts. If we consider the way continuous compounding of interest is handled, we could suggest an exponential relation:

Where:

- A0 is the amount of locked tokens

- t0 is the moment in time the tokens were locked

- t is the moment of unlocking

- Vt is the token value (e.g. in USD) at the moment of unlocking (we divide by it to make the growth exponential in terms of value, not token amount)

- α is the degree of a.g. around 1.2m but this needs to be determined

- β is the growth coefficient (to be determined as well)

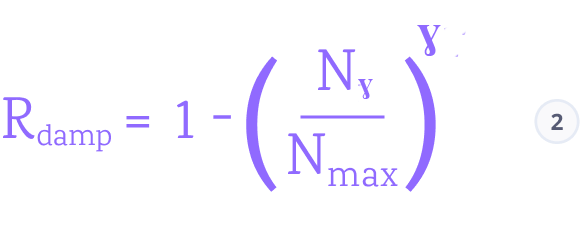

Now, formula (1) is reasonable if the overall amount of tokens given out as rewards is far below the upper limit. When it begins to approach that point, we will need to start damping the exponential growth. The idea is to multiply the exponential component by another function that starts at 1 but tends to 0 as we reach the limit. An example of such a function is:

Where:

- Nγ is the total amount of tokens given out as rewards so far

- Nmax is the maximum allowed amount of tokens provided for rewards (i.e. 0.5-3% of the total token supply at the moment)

- γ is the damping coefficient (higher values of γ will make this component stick close to 1 for longer, at the price of a steeper increase as we come near to the limit; lower values would make the initial drop more drastic)

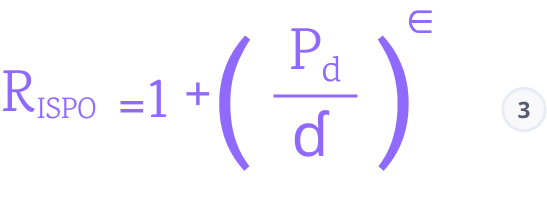

Finally, we need another multiplicative term that reflects a person's participation in the LSPO. For someone not participating, this term should just be 1 and have no bearing on the overall reward. In the case of participants, it makes sense to consider their relative contribution (percentage). Two open questions (reflected by two additional parameters) are:

- What is the maximum reward boost for a hypothetical case of a sole participant?

- How should the increment due to LSPO participation grow with a growing percentage? Should it be linear, sublinear, superlinear?

This leads us to the following candidate function:

Where:

- Pd is the fraction of a person's delegated tokens compared to the total volume (a real number between 0 and 1)

- ε is the coefficient determining how the LSPO increment depends on Pd (an ε of 1 would mean a linear relationship, higher values would favor high percentages disproportionately, and lower values would favor moderate participation)

- δ is a coefficient limiting the maximum reward boost due to participation in the LSPO (if δ is small, a hypothetical sole LSPO participant would see a drastic increase in their reward; if it's large, the LSPO effect on the overall reward is negligible; δ ≈ 2 translates to a boost by a factor of 1.5 in the extreme case)

The final reward function is the product of (1), (2), and (3):

Claiming Rewards

In February 2023, Iagon airdropped 17.5% of all ISPO rewards to ISPO participants.

The remaining rewards were subject to a 12-month linear vesting schedule and have been released proportionally month by month, available to be claimed by participants through the DripDropz platform.

For community members who participated in our original ISPO, rewards can be claimed at DripDropz Rewards are made available every month.

[!NOTE] Final ISPO Rewards Claim Deadline — 1 October 2025

To finalize the ISPO program and align with industry best practices, all unclaimed ISPO rewards must be claimed before 1 October 2025.

After this date, unclaimed tokens will be returned to the Iagon treasury and allocated to future community incentive programs.

Previous ISPO

Iagon held an ISPO (Initial Stake Pool Offering) that spanned from April 2022 - February 2023 and saw a total of 70,000,000 $IAG tokens get distributed to delegators of the stake pool.

The ISPO event is no longer active, participants wishing to participate should look to our LSPO to find out how they can earn rewards by delegating their ADA.

Commitment to Safety

Our commitment to the safety and security of our pools runs deep. We've left no stone unturned in our efforts to protect against potential supply chain attacks. We've rigorously tested for privilege escalations and subjected our pools to multiple rounds of security audits.

Our efforts don't stop there. We're constantly monitoring the performance metrics of our pools through automation and vigilant oversight. We've even gone the extra mile by setting up timesync devices and redundancies to ensure our pools never miss a beat.

We take our responsibility seriously, and our users can rest assured that their assets are safeguarded at all times.

FAQ

Is the LSPO different from the Original ISPO?

YES. The original ISPO was an event we held in the past that ended near the start of 2023. The LSPO is a different program aimed to benefit the depth of liquidity across Cardano DEXs directly.

Can you delegate to the LSPO even if you don’t provide liquidity on a DEX?

YES. Providing liquidity is not a prerequisite for delegating ADA to the LSPO pool. Users can choose how they would like to participate in the Liquidity Program either by providing liquidity on DEXs, delegating to the LSPO, or both.

How long do we have to delegate to the LSPO?

There’s no deadline — the LSPO is an ongoing program. You can start delegating at any time. Rewards are tied to specific tokens added to the LSPO reward pool — each token has its own 12-month reward period starting from the day it’s added.

How do I claim rewards from the Liquidity Program?

Rewards for participating in the Liquidity Program will begin distribution following their respective release schedules.